Maintaining a good credit score has become more crucial in an era where financial health is paramount. AI Credit Repair leverages cutting-edge artificial intelligence and machine learning technologies to revolutionize credit management. By offering personalized, efficient, and precise solutions, AI transforms the traditionally cumbersome and opaque credit repair task into a streamlined and accessible endeavor. This innovation accelerates the path to improved credit scores and democratizes access to professional financial guidance, ensuring more individuals can achieve and maintain robust economic health.

What is AI Credit Repair?

AI Credit Repair employs advanced algorithms and sophisticated machine learning techniques to scrutinize credit reports and pinpoint areas for enhancement. These cutting-edge technologies offer personalized solutions that efficiently improve credit scores, transforming the landscape of credit management. By leveraging AI’s analytical prowess, individuals can navigate the complexities of credit repair with unprecedented ease and precision.

Benefits of AI Credit Repair

Faster Credit Analysis

AI algorithms possess the remarkable capability to assess credit reports, significantly accelerating the repair process swiftly. Traditional methods often involve manual review, which can be time-consuming and prone to human error. In contrast, AI-driven systems can analyze vast amounts of data in a fraction of the time, providing immediate insights and actionable recommendations.

Customized Solutions

AI tailors its recommendations based on individual credit profiles, optimizing results for each user. This level of customization ensures that the solutions are effective and uniquely suited to address the specific issues identified in a person’s credit report. By offering bespoke advice, AI helps users achieve better outcomes than generic, one-size-fits-all approaches.

Continuous Improvement

Machine learning enables AI systems to adapt and improve, offering ongoing benefits. As the system processes more data and receives feedback, it becomes increasingly adept at identifying patterns and making more accurate predictions. This continuous learning process ensures that the AI remains current with the latest credit trends and regulatory changes, enhancing its efficacy.

How AI Credit Repair Works

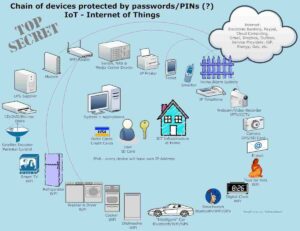

Data Gathering

The process begins with the AI collecting and analyzing credit data from sources such as annual credit reports. This complete data collection forms the foundation for all subsequent analyses and recommendations, ensuring the AI has a full and accurate picture of an individual’s credit history.

Pattern Recognition

AI uses advanced pattern recognition capabilities to identify trends and anomalies in the credit data. This involves comparing the collected information against local and state statutes and established financial norms to detect any irregularities or discrepancies that could affect the credit score.

Decision Making

Based on its analysis, the AI generates personalized recommendations and formulates strategies for credit improvement. This might include creating detailed dispute letters, suggesting optimal payment plans, or identifying potential areas for reducing debt. The recommendations are tailored to the individual’s unique financial situation and goals.

Monitoring

AI continuously monitors credit activities and adjusts strategies accordingly. This ongoing surveillance ensures that the credit repair process is dynamic and responsive to changes in the individual’s financial behavior or credit status. The AI can promptly address new issues by maintaining a vigilant eye on credit activities.

How Does AI/ChatGPT Analyze Credit Reports?

Data Extraction

AI algorithms can extract pertinent information from credit reports, such as incorrect account details, inaccurate balances, or erroneous late payments. This automated extraction process ensures no critical information is overlooked, setting the stage for precise and thorough analysis.

Discrepancy Identification

Through sophisticated pattern recognition, AI identifies discrepancies between the information on the credit report and actual financial records. By detecting these inconsistencies, AI can pinpoint the items that must be addressed to improve the credit score.

Letter Composition

Based on the identified discrepancies, AI generates comprehensive dispute letters. These letters detail the disputed items, explain why they are inaccurate, and include any supporting documentation. This automated letter composition ensures that disputes are articulated clearly and professionally, enhancing the chances of a favorable response from credit bureaus.

Customization

AI tailors each dispute letter to adhere to specific legal requirements and guidelines set by credit reporting agencies and regulatory bodies. This customization ensures compliance and increases the likelihood of a successful dispute resolution.

Language Optimization

AI ensures that the language used in the dispute letter is clear, concise, and professional. By optimizing the wording, AI enhances the effectiveness of the communication, making it more likely that the credit bureaus will respond positively.

Proofreading and Editing

AI performs thorough proofreading and editing to ensure the dispute letter is free from grammatical errors and formatting issues. This meticulous attention to detail ensures the final document is polished and professional.

Document Management

AI manages the entire documentation process, organizing relevant attachments and ensuring all necessary materials are included in the dispute letter. This streamlined approach saves time and effort increasing the accuracy and effectiveness of the credit repair effort.

Future of AI in Credit Repair

The future of AI in credit repair is not just promising, but also poised to be transformative, with advancements in deep learning, natural language processing, and predictive analytics. These innovations hold the potential to make credit repair more accessible, efficient, and effective for consumers worldwide. As AI technology carry on with to develop, it will likely introduce even more sophisticated tools and methodologies, further simplifying the credit repair process. This transformative nature of AI credit repair is what makes the future of credit repair so intriguing and exciting.

Enhanced Consumer Accessibility

Integrating AI in credit repair democratizes access to high-quality financial advice and credit management tools. Historically, effective credit repair services were often out of reach for many consumers due to high costs or lack of availability. However, AI-powered solutions can be offered at a fraction of the cost, making them ready for a broader audience. This inclusivity ensures that more respective can benefit from professional-grade credit repair without the financial burden traditionally associated with such services.

Predictive Analytics

One of the most promising advancements in AI credit repair is using predictive analytics. By inspecting historical data and identifying trends, AI can predict future credit behaviors and potential issues before they arise. This proactive approach allows consumers to address potential problems early, preventing negative impacts on their credit scores. Predictive analytics can also help create more effective financial plans, ensuring long-term credit health and stability.

Natural Language Processing

Natural Language Processing (NLP) significantly enhances the interaction between AI systems and users. With advanced NLP capabilities, AI can understand and respond to user queries more intuitively and conversationally. This makes the credit repair process more user-friendly, as individuals can communicate their needs and receive assistance in a format that feels natural and accessible. Moreover, NLP allows AI to generate more personalized and contextually relevant advice, further improving the effectiveness of credit repair strategies.

Deep Learning

Deep learning algorithms enable AI to perform more complex analyses and draw more accurate conclusions from large datasets. In the context of credit repair, deep learning can help identify subtle patterns and correlations that traditional analysis methods might miss. This deeper insight leads to more precise recommendations and a higher likelihood of successful credit repair outcomes. As deep learning technologies continue to advance, their application in credit repair will only become more sophisticated and beneficial.

Conclusion

AI credit repair represents a significant leap forward in personal finance management. Controlling the power of advanced algorithms, machine learning, and AI technologies offers faster, more accurate, and personalized solutions for improving credit scores. The continuous evolution of AI promises even greater advancements, making credit repair more accessible and effective for a global audience. As we embrace these innovations, we can look forward to a future where managing and improving credit is no longer daunting but a seamless, efficient, and empowering experience.